AI Training Data For Finance Industry

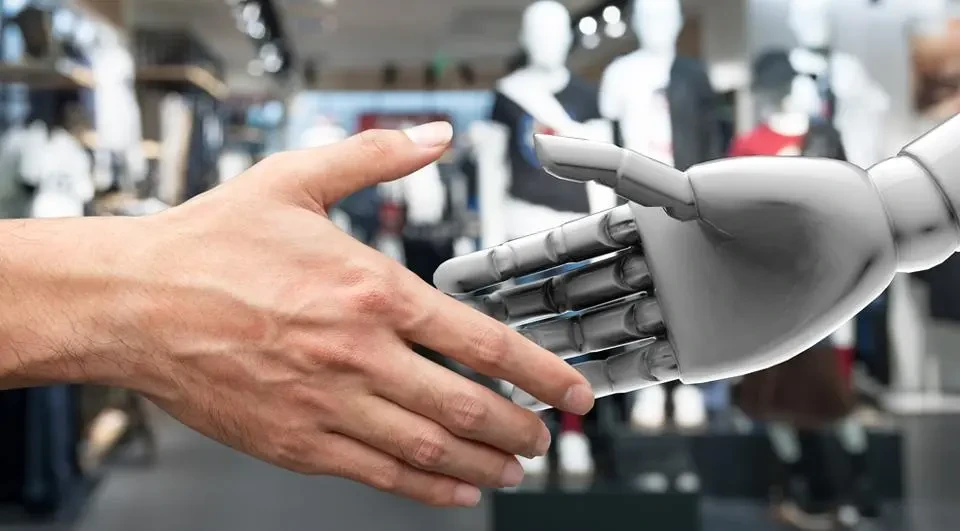

Revolutionizing Finance with AI-Enhanced Datasets

Precision data collection and annotation services for the evolving financial sector.

Home » Industries » Financial Services

Solve your business problems with ours

industry solutions

Fraud Detection

AI In Finance In the field of Fraud Detection, image datasets of transaction records and patterns are invaluable resources. Consequently, they play a crucial role in training AI models to identify and, subsequently, prevent fraudulent activities. Moreover, these datasets enable the development of more accurate and robust detection systems. Additionally, by leveraging such datasets, businesses can enhance their security measures and, therefore, protect against potential fraud.

These datasets encompass a wide range of visual information related to AI In Finance transactions, including graphs, charts, and historical records. Moreover, they provide comprehensive insights into transaction patterns. Additionally, these datasets facilitate trend analysis. Furthermore, they support predictive modeling for better financial decision-making.

Utilizing machine learning algorithms, these datasets enable the development of robust fraud detection systems that can quickly recognize unusual or suspicious patterns in financial data. Consequently, by continuously analyzing and learning from data, these systems enhance their accuracy over time. Furthermore, integrating such technologies helps organizations proactively mitigate risks, thereby ensuring the security and integrity of financial transactions.

Such AI models play a crucial role in safeguarding businesses and individuals against fraudulent transactions, thereby protecting financial assets and consequently maintaining trust in financial systems. Furthermore, these models enhance the overall security framework, ensuring that both businesses and consumers can operate with confidence. Additionally, by continuously monitoring transactions and detecting anomalies, AI models contribute to the prevention of financial crimes. As a result, the implementation of AI in the financial sector not only improves security but also fosters a trustworthy environment for all stakeholders.

systems.

Customer Service & Chatbots

- In the realm of Customer Service & Chatbots, audio and text datasets serve as foundational resources for training AI-driven customer support systems, ultimately enhancing the user experience.

These datasets encompass a wide array of customer interactions, including text-based chats, phone call transcriptions, and recorded customer service conversations. Moreover, they provide comprehensive insights into customer behavior, preferences, and issues.

By leveraging AI In Finance data, machine learning models can be developed to understand user inquiries, subsequently providing relevant information and offering solutions in a natural and responsive manner. Furthermore, these models can continuously learn from user interactions, thereby improving their accuracy and effectiveness over time.

As a result, businesses can deliver more efficient and personalized customer support, reducing response times and improving overall satisfaction.

These AI-driven chatbots and support systems, moreover, play a pivotal role in enhancing customer service across various industries. Consequently, they streamline interactions, improve response times, and ultimately elevate the overall customer experience.

Algorithmic Trading

In the field of Algorithmic Trading, time-series and historical trading data are, undoubtedly, critical datasets. These datasets are utilized to train AI models, ultimately enabling the prediction of stock market movements. Consequently, the reliance on such data underscores the importance of accuracy and thoroughness in data collection.

These datasets contain a wealth of information, including stock prices, trading volumes, and market indicators, spanning over different time intervals. Moreover, they provide valuable insights into market trends and investor behaviors. Additionally, the data helps in forecasting future market movements and making informed investment decisions.

Machine learning algorithms leverage this data to identify patterns, trends, and potential market signals, thus enabling automated trading decisions. Consequently, these advanced techniques enhance the precision of market predictions. Additionally, they help in optimizing trading strategies, thereby increasing profitability.

- By analyzing vast amounts of historical trading data, AI models can make data-driven predictions, optimize trading strategies, and manage risk more effectively.

- Algorithmic trading powered by these datasets has revolutionized financial markets, enabling faster and more precise trading decisions.

Digital Banking

- In the realm of Digital Banking, image and video datasets are indispensable for training facial recognition systems, which enhance the security of account access and transactions.

- These datasets include a wide variety of facial images and video clips, capturing different angles, lighting conditions, and expressions.

- Machine learning models use this data to develop robust facial recognition algorithms that authenticate users with high accuracy.

- Facial recognition technology in digital banking ensures secure and convenient access to accounts and validates transactions, reducing the risk of unauthorized access and fraud.

- These advancements in security contribute to a seamless and trusted digital banking experience for customers.

Credit Scoring

- In the domain of Credit Scoring, text datasets from various sources, such as loan applications, credit histories, and customer feedback, play a crucial role in enhancing credit scoring algorithms through AI.

- These datasets contain a wealth of textual information related to individuals’ financial profiles, loan requests, and customer experiences.

- Machine learning models leverage this data to extract insights, assess creditworthiness, and refine scoring models, improving their accuracy and predictive power.

- By incorporating natural language processing techniques, AI algorithms can analyze unstructured text data to gain a more comprehensive understanding of borrowers’ financial situations.

- These data-driven enhancements lead to more informed lending decisions, reduced risk, and improved financial services for both lenders and borrowers.

ATM & Branch Services

- In the domain of ATM & Branch Services, video datasets are invaluable resources capturing ATM usage patterns, branch interactions, and customer behaviors, serving to optimize services and security.

- These datasets encompass a wide range of visual information, including customer interactions with ATMs, branch visits, and security footage.

- Machine learning models utilize this data to analyze customer behaviors, detect unusual activities, and enhance the overall security of banking facilities.

- Additionally, these datasets provide insights into customer preferences and service utilization, aiding in the improvement of branch layouts and ATM placement for better customer experiences.

- Through data-driven optimization, ATM & Branch Services continue to evolve to meet the changing needs of customers while maintaining high-security standards.

What We Offer

Data Collection Services

At GTS, we understand the imperative of high-quality, pertinent data for your business. Leveraging our expansive network in the

Data Annotation Services

At GTS, we understand the imperative of high-quality, pertinent data for your business. Leveraging our expansive network in the

Data Transcription Services

At GTS, we understand the imperative of high-quality, pertinent data for your business. Leveraging our expansive network in the

Why Choose Us for Finance

Industry Expertise

Deep understanding of the retail sector's unique challenges and needs.

Global Reach

Datasets that capture diverse shopping behaviors from around the world.

Ethical Data Collection

Ensuring every piece of data is collected ethically, with necessary consents.

Custom Solutions

Tailored datasets to match specific retail applications and requirements.

Quality Data Creation

Guaranteed TAT

ISO 9001:2015, ISO/IEC 27001:2013 Certified

HIPAA Compliance

GDPR Compliance

Compliance and Security

We are an ISO 9001:2015, ISO/IEC 27001: 2013 certified IT enabled AI dataset provider.

Other Case Study

Let's Discuss your Data collection Requirement With Us

To get a detailed estimation of requirements please reach us.