Insurance Dataset

Home » Case Study » Insurance Dataset

Project Overview:

Objective

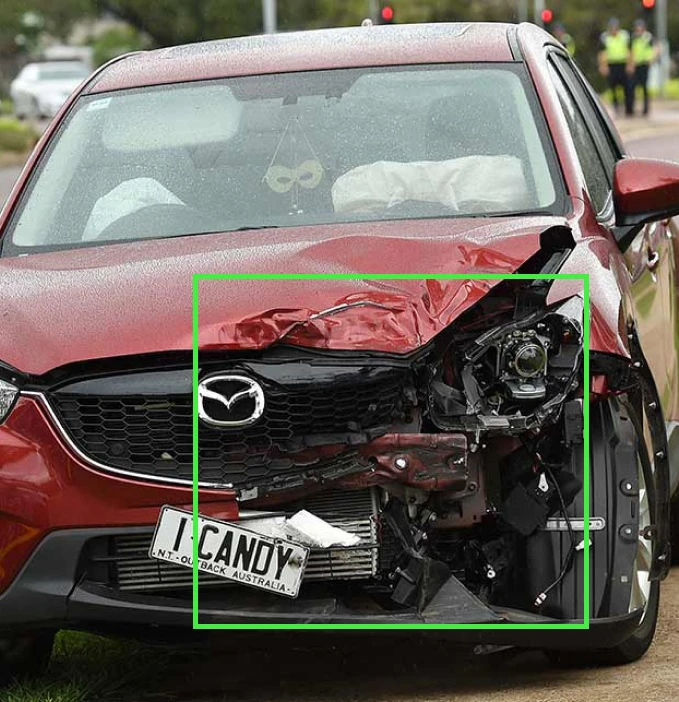

The Insurance Dataset project is an extensive initiative focused on collecting and analyzing insurance-related data from various sources. This project aims to create a comprehensive dataset that captures a wide array of insurance domains, including health, auto, life, and property insurance.

Scope

The project encompasses data from numerous insurance types and covers various aspects such as claim histories, policy details, customer interactions, and risk profiles. The dataset includes both structured and unstructured data, providing a holistic view of the insurance industry.

Sources

Data is collected from a variety of sources, including insurance companies, online platforms, customer surveys, and claim databases. All data collection complies with privacy laws and ethical standards, ensuring data integrity and confidentiality.

Data Collection Metrics

- Total Records Collected: 500,000

- Insurance Domains Covered: Health, Auto, Life, Property

- Geographical Coverage: 30 countries, with a focus on North America, Europe, and Asia

- Data Types: Policy details, claim records, customer profiles, risk assessments

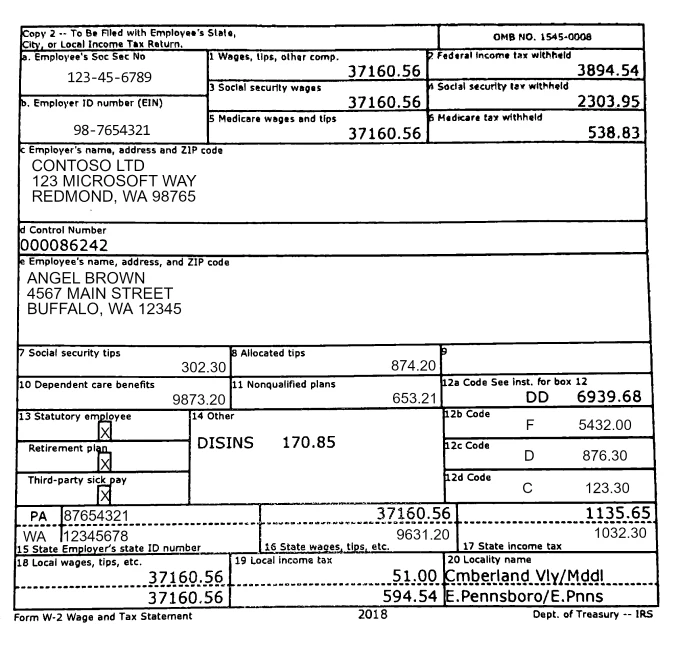

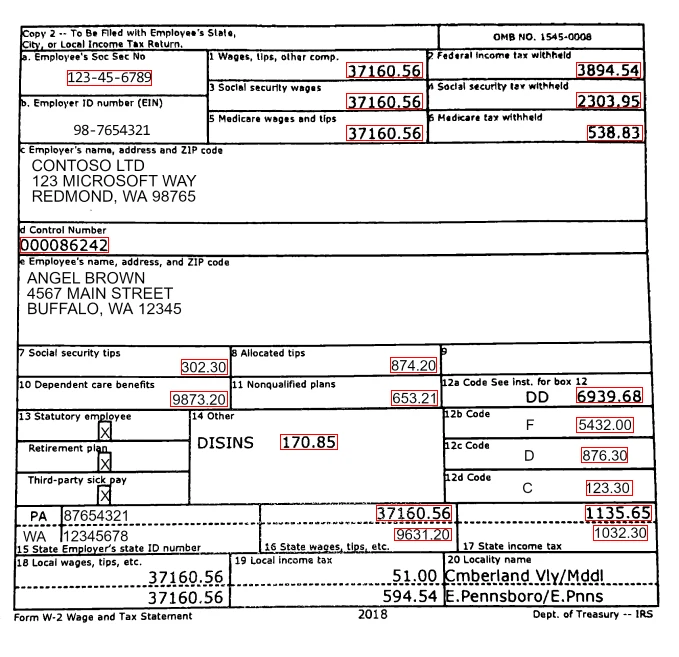

Annotation Process

Stages

- Data Categorization: Organizing data by insurance type, region, and policy details.

- Risk Factor Analysis: Annotating data with risk factors and historical claim information.

- Customer Feedback Tagging: Integrating customer satisfaction scores and feedback.

Annotation Metrics

- Total Records Annotated: 500,000

- Unique Annotations: 2,500,000

- Average Annotations per Record: 5

Quality Assurance

Stages

Objective: Ensure the dataset remains accurate and relevant to the insurance industry’s evolving needs.

Activities: Periodically reassess and update the dataset to reflect changes in insurance policies, emerging trends in risk factors, and updates in regulatory requirements. This stage involves re-evaluating the existing data for relevance and accuracy, adding new data as industry practices evolve, and refining data categorization.

QA Metrics

- Data Accuracy: 99%

- Annotation Consistency: 98%

- Completeness of Risk Factor Analysis: 97%

Conclusion

Our Insurance Dataset project stands as a testament to our commitment and capability in creating high-quality, industry-specific datasets for machine learning. This project has set a new standard in the insurance industry, offering unprecedented improvements in processing efficiency, fraud detection accuracy, and overall operational effectiveness.

Quality Data Creation

Guaranteed TAT

ISO 9001:2015, ISO/IEC 27001:2013 Certified

HIPAA Compliance

GDPR Compliance

Compliance and Security

Let's Discuss your Data collection Requirement With Us

To get a detailed estimation of requirements please reach us.