Fraud Detection in Financial Transactions

Home » Case Study » Fraud Detection in Financial Transactions

Project Overview:

Objective

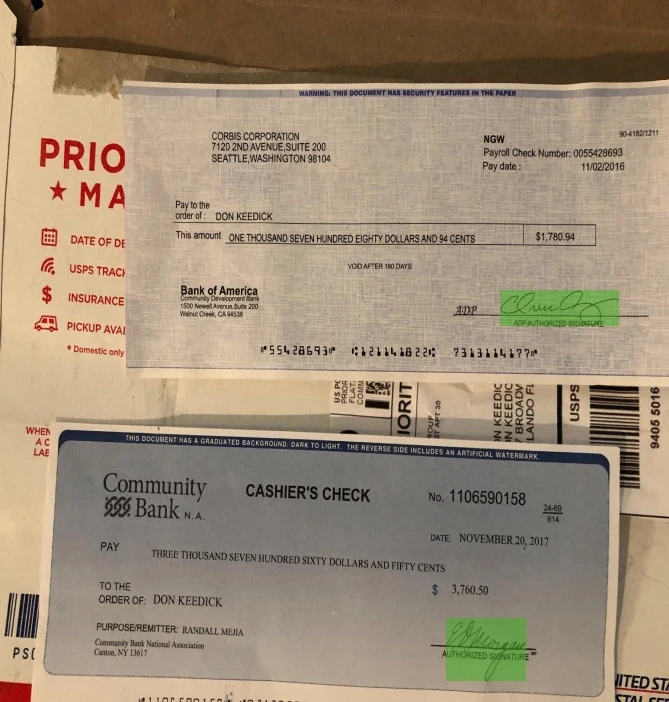

Fraud detection is crucial in the dynamic world of financial transactions. Our mission is to swiftly pinpoint and curb unauthorized or fraudulent activities. By doing so, we safeguard not only financial institutions and their clients but also the integrity of the broader financial system.

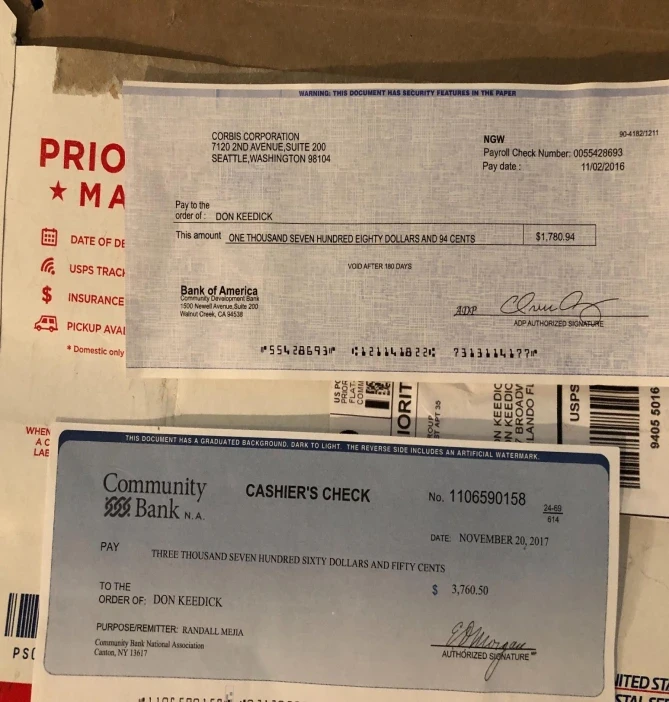

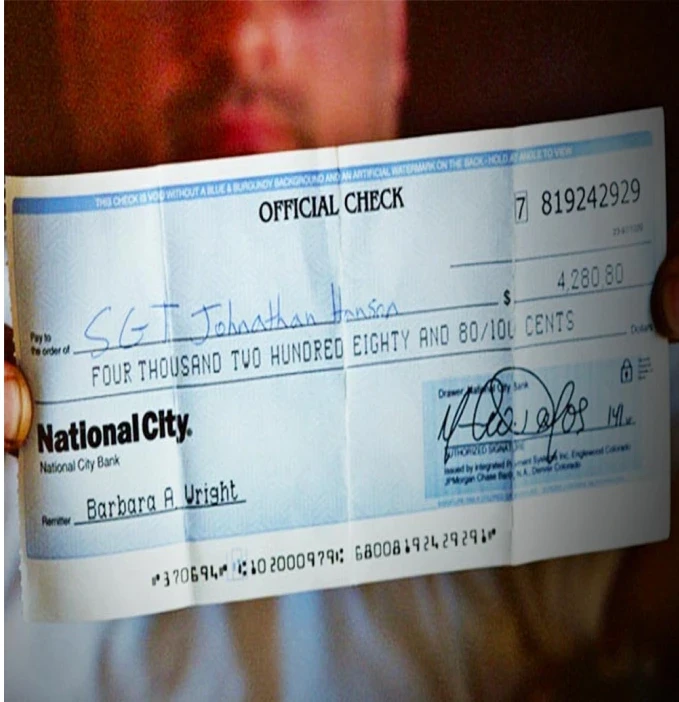

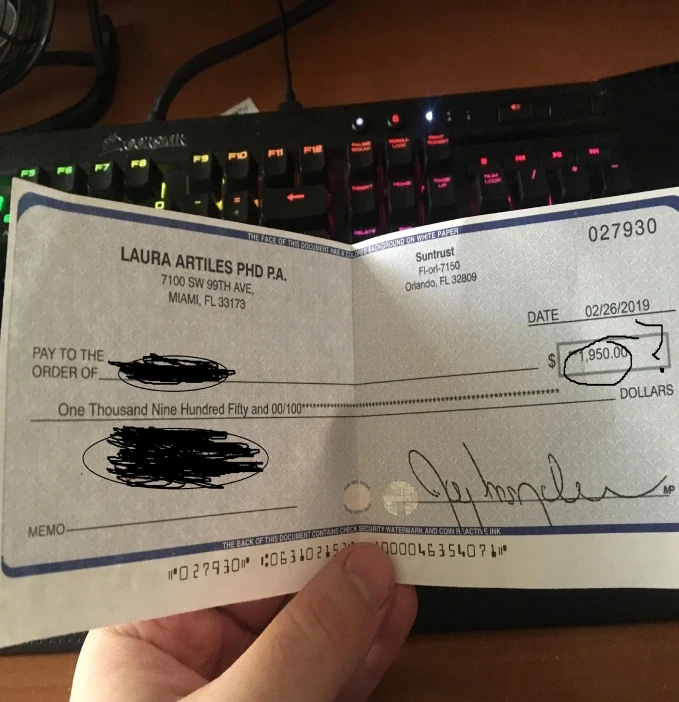

Scope

Sources

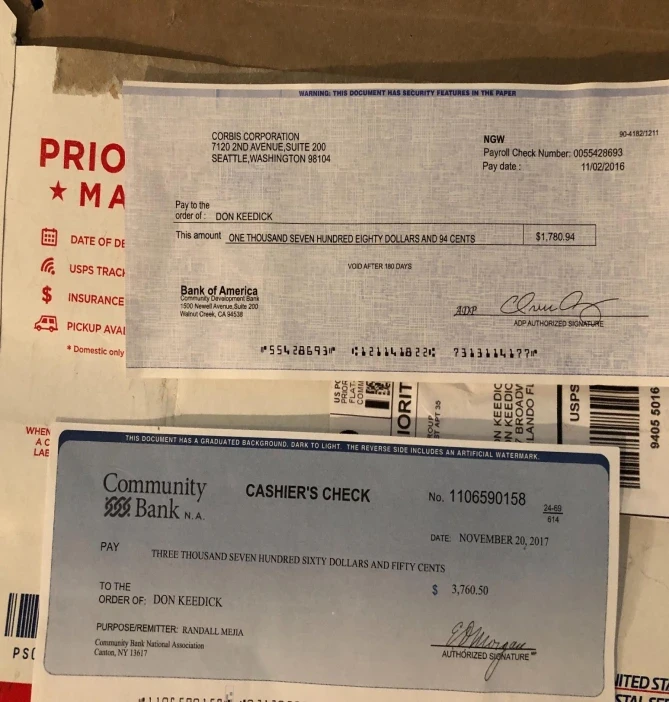

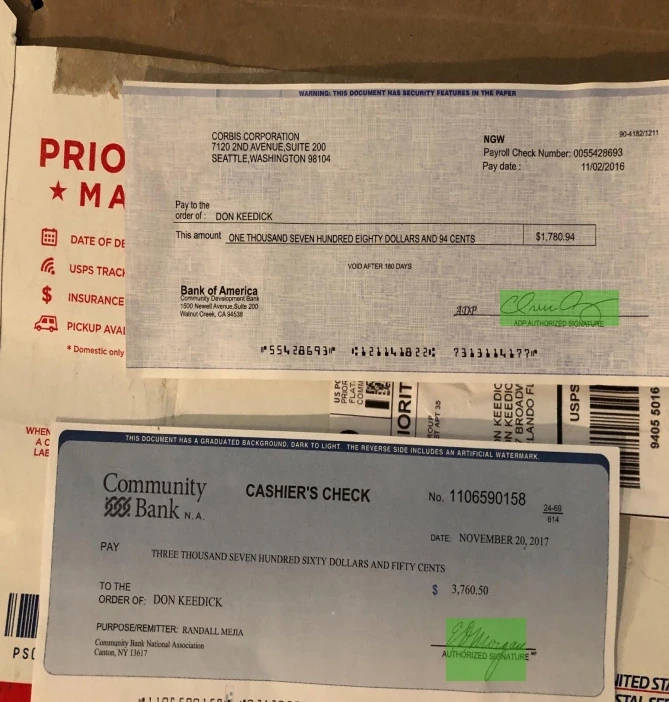

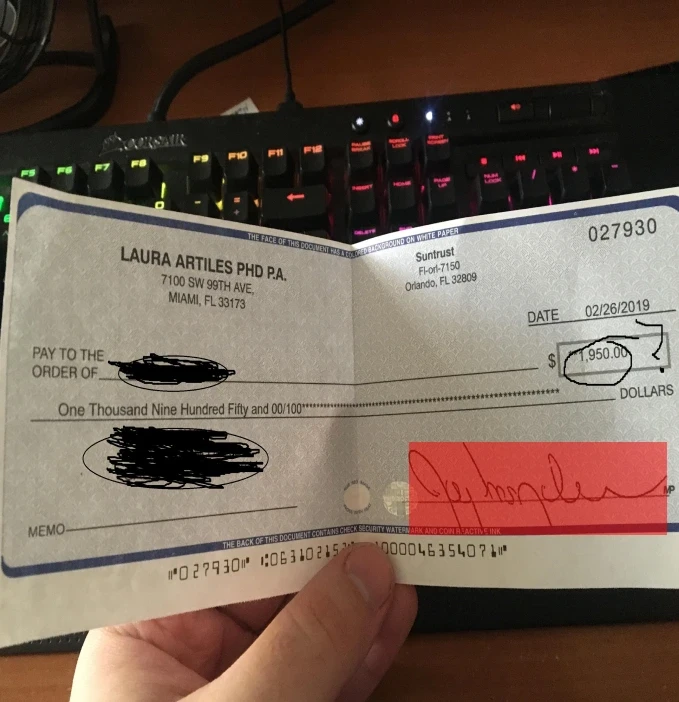

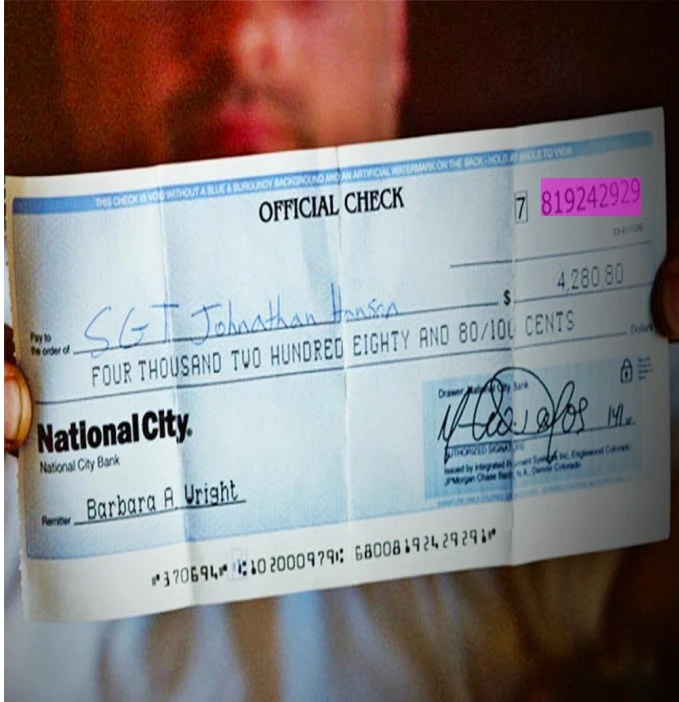

- Transaction Data:We’ve amassed a rich collection of historical and real-time transaction data, which offers unparalleled insights into transactional patterns and potential fraud indicators

- Machine Learning Models: Furthermore, by leveraging predictive models and sophisticated algorithms, our datasets serve as the backbone for analyzing transactional anomalies and recognizing fraud signatures.

Data Collection Metrics

- Completeness: Our dataset includes over 5 million transactions, thus ensuring extensive coverage.

- Accuracy: Moreover, each transaction record is meticulously verified for correctness.

- Timeliness: Furthermore, our real-time data collection process ensures up-to-the-minute accuracy.

- Volume: Additionally, we have collected and annotated over 3 million data points, offering a robust foundation for our AI and machine learning models.

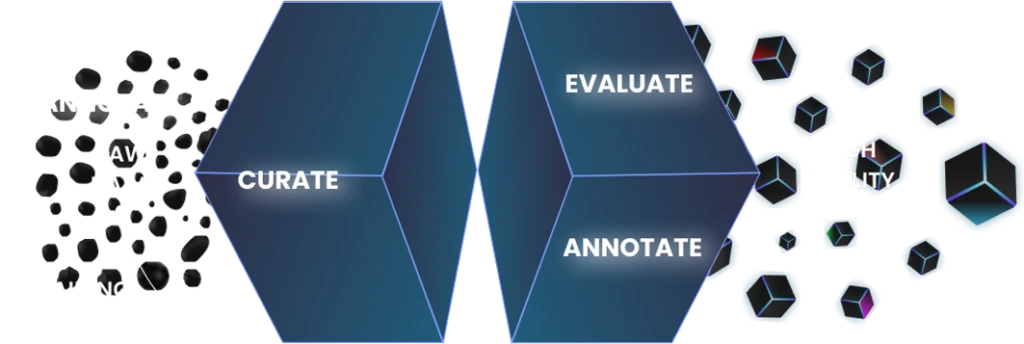

Annotation Process

Stages

- Planning: We strategically outline our objectives and methodologies for data collection.

- Data Gathering: Utilizing diverse sources, we accumulate a wide array of data.

- Validation: We rigorously validate data to ensure its accuracy and reliability.

- Analysis: Our team processes and distills actionable insights from the collected data.

- Reporting: We compile and present our findings in a comprehensible and engaging manner.

Annotation Metrics

- Inter-Rater Agreement: Measures annotator consensus.

- F1 Score: Assess annotation accuracy.

- Cohen’s Kappa: Accounts for chance agreement in reliability assessment.

Quality Assurance

Stages

Transcription Verification: Firstly, every piece of transcribed data is meticulously cross-referenced for accuracy.

Privacy Compliance: Additionally, we strictly adhere to global data privacy regulations like GDPR and CCPA to ensure privacy compliance.

Data Security: Moreover, advanced encryption and control mechanisms are in place to protect our data from unauthorized access, thus ensuring robust data security.

QA Metrics

- Defect Rate: We consistently exhibit a low defect rate, underscoring our commitment to quality.

- Customer Satisfaction: High customer satisfaction scores attest to our ability to meet and exceed client expectations.

Conclusion

Our proactive approach in utilizing advanced technologies for fraud detection marks a significant stride in real-time fraud prevention. In an era where fraud tactics are ever-evolving, our comprehensive data collection and annotation capabilities not only bolster the defenses of financial institutions but also reinforce trust within the entire financial ecosystem.

Quality Data Creation

Guaranteed TAT

ISO 9001:2015, ISO/IEC 27001:2013 Certified

HIPAA Compliance

GDPR Compliance

Compliance and Security

Let's Discuss your Data collection Requirement With Us

To get a detailed estimation of requirements please reach us.