Financial Dataset

Home » Case Study » Financial Dataset

Project Overview:

Objective

Our mission is to create a comprehensive financial dataset that will power cutting-edge predictive models. This dataset aims to revolutionize financial market analysis, enhance risk assessment, and improve investment strategy formulation. By incorporating advanced methodologies and leveraging innovative technologies, we aim to significantly impact the industry. Our goal is to provide a dataset that not only meets but exceeds industry standards, enabling more accurate predictions and better decision-making processes.

Scope

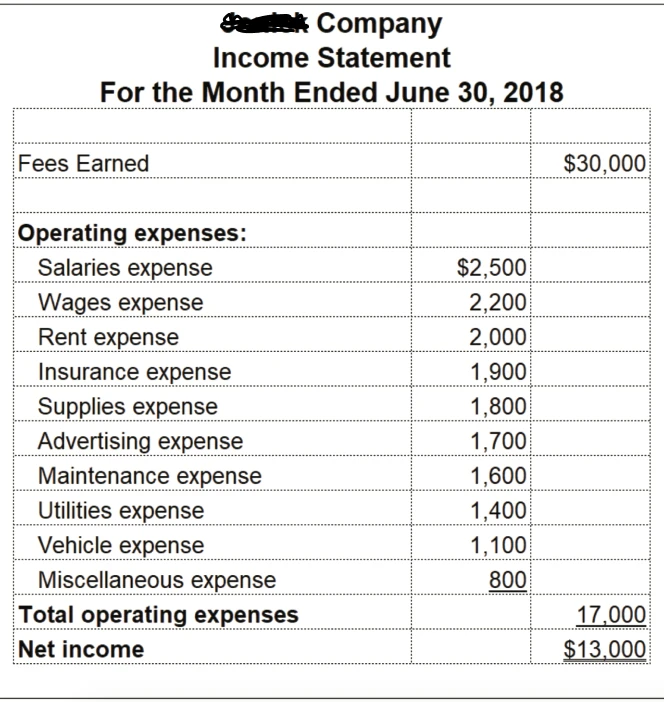

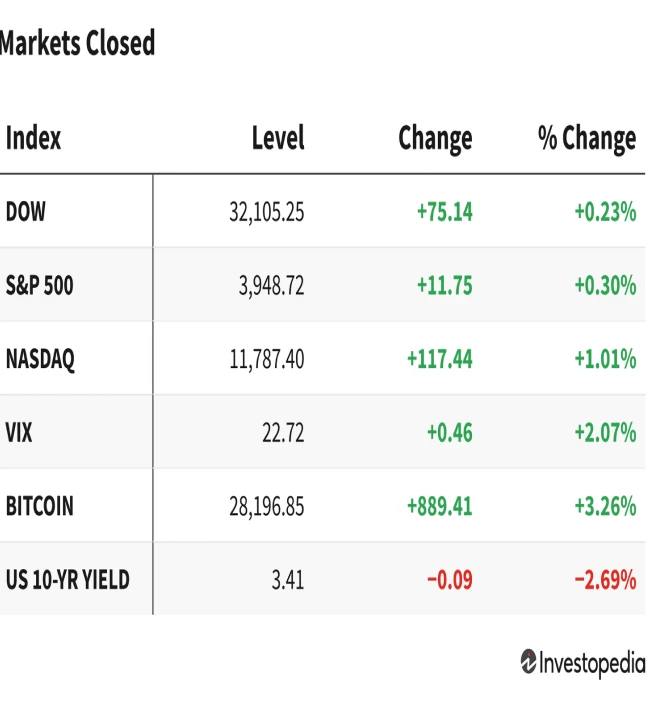

We have compiled a comprehensive financial dataset that encompasses various financial instruments, market trends, and economic indicators. This dataset includes both historical and current data, providing a broad perspective. Additionally, it offers insights into financial trends, making it valuable for analysis. By incorporating historical data, users can gain a deep understanding of market movements. Furthermore, the dataset covers current data, allowing users to stay updated with the latest financial developments.

Sources

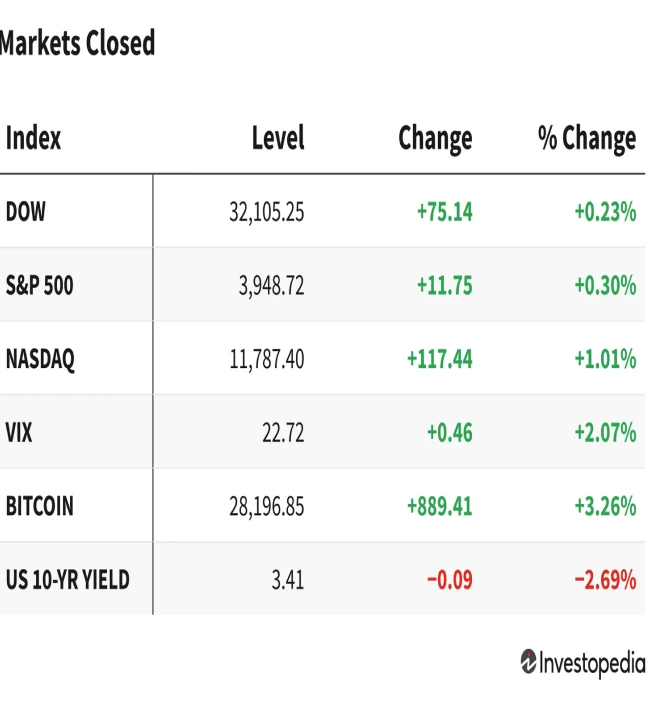

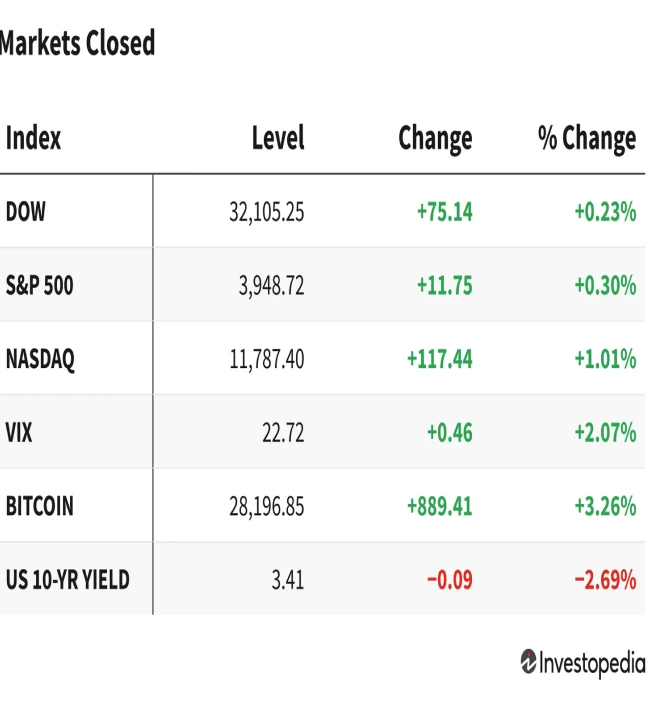

- Market Data Aggregation: We actively aggregate over 300,000 records of stock market data, including prices, volumes, and market capitalizations from major global exchanges.

- Economic Reports: We collect 100,000 entries of economic indicators, such as inflation rates, GDP growth, and employment statistics, directly from credible financial institutions.

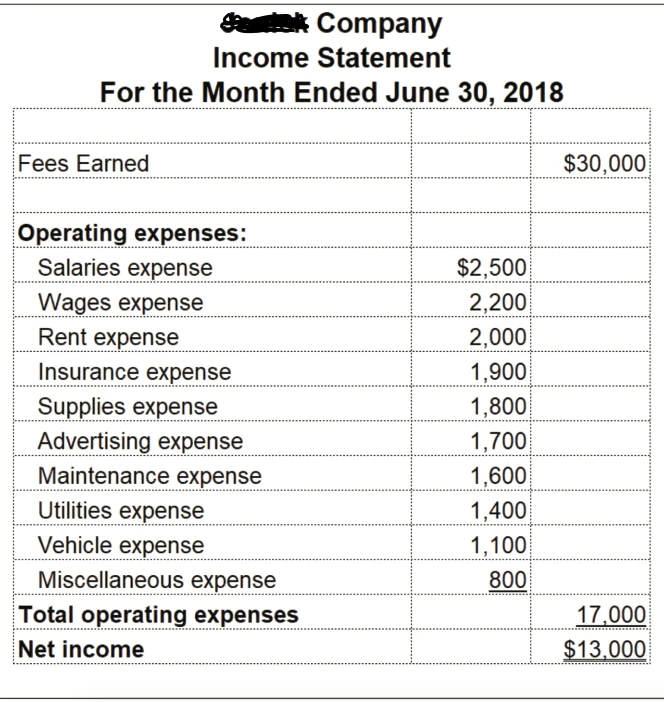

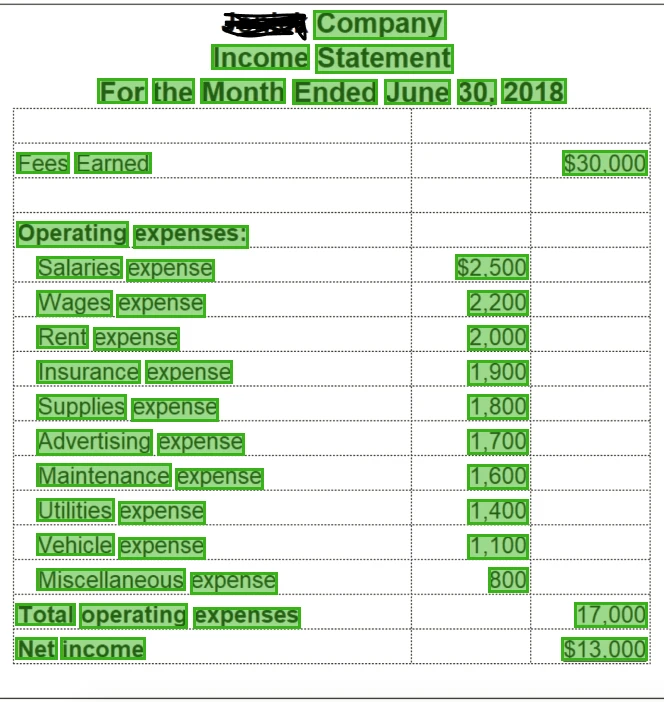

- Public Financial Statements: Our dataset features 50,000 entries from publicly available financial statements of various companies, which significantly enhances the diversity and depth of our collection.

Data Collection Metrics

- Total Records: 450,000

- Stock Market Data: 300,000

- Economic Indicators: 100,000

- Financial Statements: 50,000

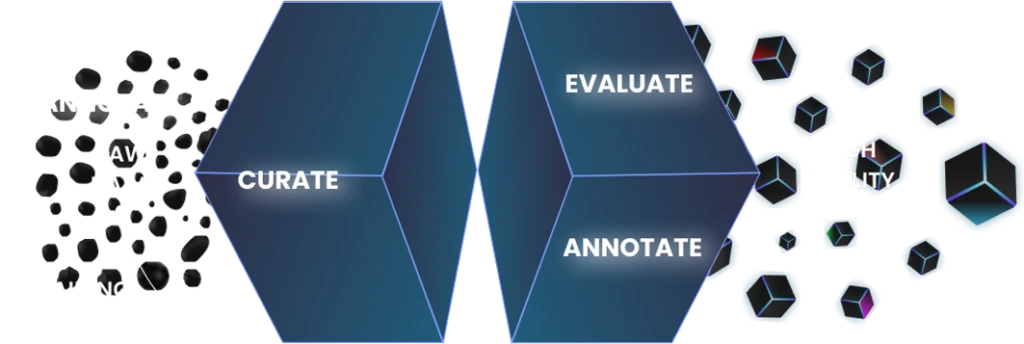

Annotation Process

Stages

- Financial Parameter Tagging: We meticulously tag each record with relevant financial parameters, such as sector, market type, and economic indicators.

- Trend Analysis Markers: We incorporate markers for analyzing trends and patterns, which are crucial for predictive analytics.

- Risk Assessment Flags: We proactively assign specific flags to each record for potential risk factors.

Annotation Metrics

- Records with Financial Tags: 450,000

- Trend Analysis Markers Apply: 450,000

- Risk Assessment Flags Assign: 450,000

Quality Assurance

Stages

Financial Parameter Tagging: We meticulously tag each record with relevant financial parameters, such as sector, market type, and economic indicators.

Trend Analysis Markers: We incorporate markers for analyzing trends and patterns, which are crucial for predictive analytics.

Risk Assessment Flags: We proactively assign specific flags to each record for potential risk factors.

QA Metrics

- Data Accuracy: 99.2%

- Update Frequency: Daily

- Compliance Adherence Rate: 100%

Conclusion

Our financial dataset has revolutionized the landscape of financial analysis and predictive modeling. Consequently, it serves as a robust foundation for AI-driven financial insights. This foundation allows for more accurate market predictions, enhanced risk assessments, and strategic decision-making in the ever-changing world of finance.

Quality Data Creation

Guaranteed TAT

ISO 9001:2015, ISO/IEC 27001:2013 Certified

HIPAA Compliance

GDPR Compliance

Compliance and Security

Let's Discuss your Data collection Requirement With Us

To get a detailed estimation of requirements please reach us.